Over the years, I have worked for companies, for myself, and started a few businesses. If you know anything about entrepreneurship, then you are aware that it is one of those bottomless rabbit-holes in which there is no end to how much you can learn. As soon as you think you have achieved a good level of understanding of something, you go back to square one. "Now what?"

Entrepreneurial experience, at various stages, includes things like company formation, banking, legal infrastructure, accounting, team building, business development, and so on. While you do not necessarily have to become an expert in each of these fields (division of labor is great!), you will need to be familiar, at least, with some basics. And if you are, I do not need to tell you how complicated, often artificially, some of these things are. Thanks, Government!

It is the year 2020, and, in my opinion, Bitcoin fixes a lot of them. Bitcoin with capital "B," that is—the technology, the protocol, the software stack.

There is no doubt in my mind that bitcoin (lowercase "b") reinvents the essential aspect of what makes capitalism so great—money itself. It does not merely return us to the gold standard, with all its deficiencies, but propels us forward into the bright future of the hardest money to ever exist, wealth accumulation and low time preference being its extremely positive side-effects.

Bitcoin the protocol, however, allows for the creation of other advanced tools that may go beyond monetary use-cases. For example:

- The Bitcoin blockchain is, in a sense, a time machine. Its unalterable database of transaction records can store additional information that, if posted, stays there for all eternity. The most famous message was published in the Genesis block by Satoshi Nakamoto himself: "Chancellor on brink of second bailout for banks."

- Using hash functions, one can post proof that any type of data existed at a particular point in time. It can be a message, a contract, a book, or a whole library. This is called timestamping and is the main concept behind the OpenTimestamps protocol built on top of Bitcoin.

- The Lightning Network, built as a highly scalable second-layer payment solution, is already being adapted to other use-cases, such as instant messaging.

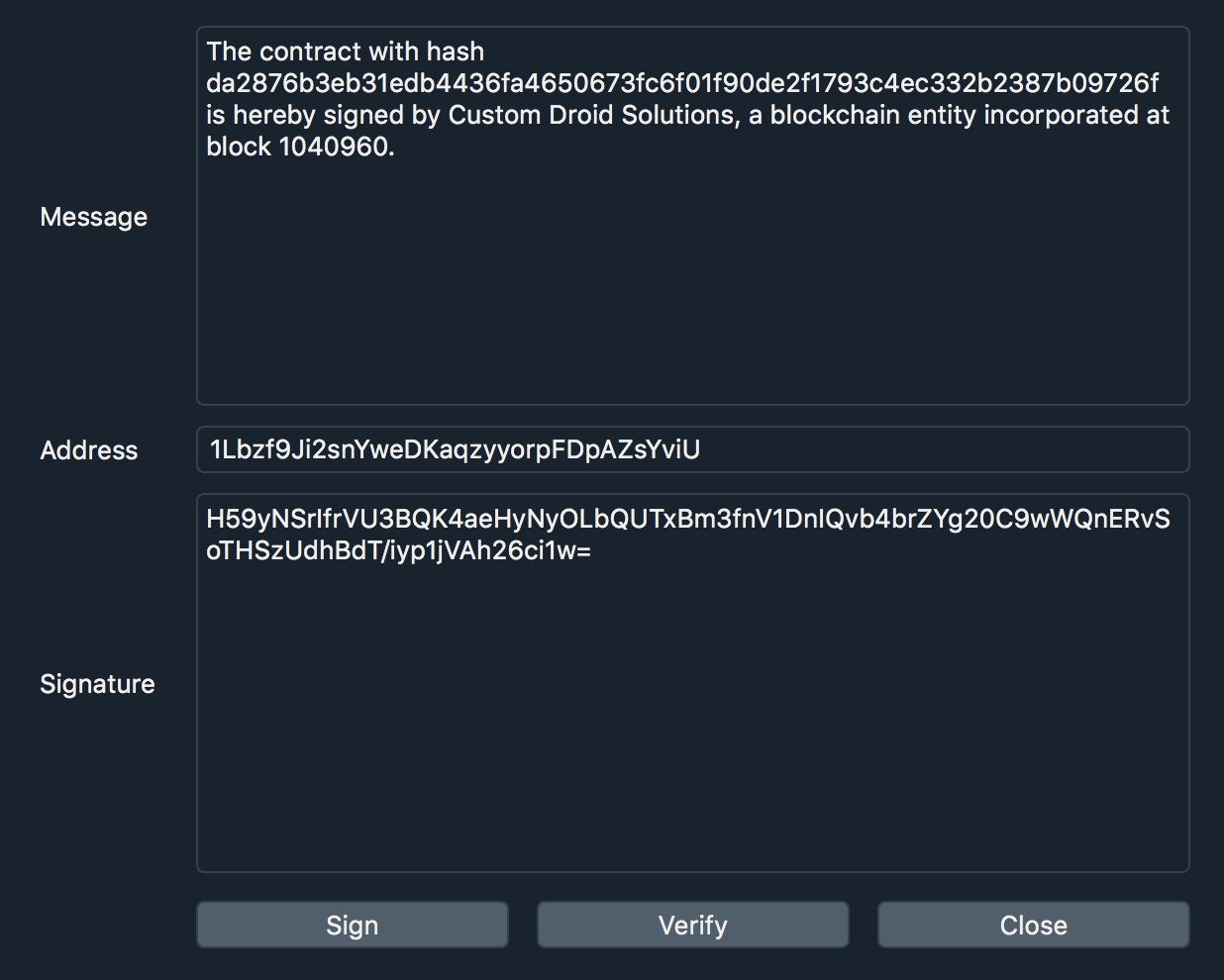

- Based on public-key cryptography, bitcoin wallets themselves have the ability to perform non-monetary functions like signing and verifying custom messages.

- Decentralized identity systems (DID) are also being built on top of Bitcoin, with Microsoft's open-source initiative called ION leading the way.

In this thought experiment, I will explore a system that allows you to start and run an unregulated business using Bitcoin and technologies built on top of it. But first—why?

Today's Business Environment

If you want to start a business in your country, you will have to go through the standard process of company formation: incorporation, registration with local and/or federal tax authorities, office space lease, infrastructure set-up (hardware, software, furniture, etc.) and so on. But in our digital age, a growing number of businesses choose to go purely online. They have no office or employees. As a matter of fact, all they need to operate is a computer with an Internet connection. Sometimes, they can even manage with just a smartphone!

It is no wonder, then, that more and more young individuals that engage in remote businesses choose to work from home or even travel around the world. Digital nomadism is becoming a popular lifestyle among professional bloggers, YouTube video creators, graphic designers, programmers, marketers, online coaches, and consultants.

Moreover, the Internet allows entrepreneurs to pursue a much broader audience, not limited by their home country's borders. Revenue generation potential has never been greater!

For various reasons, the biggest being tax liability, the vast majority of such service providers prefer to do business as self-employed or to register an actual company, depending on the advantages and disadvantages of either approach as per their country's tax code. More international-minded individuals, however, are starting to figure out what has been known to wealthy businessmen and large corporations for many years—the perks of offshore jurisdictions.

"An Offshore Financial Centre or OFC is defined as a country or jurisdiction that provides financial services to nonresidents on a scale that is incommensurate with the size and the financing of its domestic economy."—Wikipedia

Those who consume too much mainstream media will frown upon the term. "It's for criminals and tax evaders!" While unsavory elements have, indeed, used offshore tax havens for their shady deals, there is absolutely nothing wrong with the concept itself. After all, it is only technology. Criminals are known for adopting the best and most promising technologies before anybody else does. Do you remember bitcoin's early days?

Why do honest Internet entrepreneurs choose offshore jurisdictions, such as the British Virgin Islands, Panama, Singapore, the Cayman Islands, the Marshall Islands, Malta, and others to establish their businesses in? The answer is simple—the profit motive. Below is a list of some advantages of doing business as a BVI entity:

- Corporate flexibility

- Corporate efficiency

- Minimal capitalization requirements

- Tax neutrality

- Low cost

- Fast company formation

- Efficient company maintenance

- Confidentiality

Very often, in practical terms, you will enjoy 0% corporate tax, 0% capital gains tax, no bookkeeping requirements, no publicly accessible shareholder or director records, and political stability. More importantly, incorporating in such a jurisdiction, thanks to competition between them, has become affordable enough: for a few hundred dollars, you can have your company ready to go in just a couple of business days!

A question then arises: If you do not need to pay corporate taxes, report to anyone, and keep records of your transactions, why incorporate at all? Why not just do business as is, using all the same online tools? A few reasons exist today:

- Taxation. This is the biggest impediment. In most countries, if you operate not under a corporation but under your name, you will need to pay personal income tax. Local authorities do not really care whether your income comes from within your home country or from international sources. Corporations are legal entities that are treated differently when it comes to taxes, which is what opens jurisdictions up to competition in this domain. Your country may have a 15% personal income tax and a 20% corporate tax. An offshore jurisdiction, on the other hand, may have a similar personal income tax but a 0% corporate tax. That is a decisive figure!

- Banking. You will have a hard time opening a bank account in a foreign jurisdiction under your name. A corporate bank account, however, usually comes as part of the package with many registrar agents!

- Law. In case of a dispute, where would litigation take place if you operate under your name? This point can be specified in the contract with the other party, such as a client or a vendor. If it is not, then you may insist on your country of origin. Many, however, do not like that. A corporation is often attached to the legal system of its domicile (offshore, it is usually English common law), and this gives clarity to all the parties involved. Notably, suing anonymous offshore corporations is quite difficult. In essence, it is easier and cheaper to shut down your company and open a new one in a matter of days than being exposed to a lawsuit.

I hope this brief overview gives you an idea of what international business looks like today. In the following section, allow me to transfer us into the not-so-distant future.

Enterprise of Tomorrow

Case Study

Today is a great day! You have never been more excited about your droid software business. Time to get straight to work.

You fire up your workstation with its crystal clear holographic display, click the TBBS icon in the Launcher, and are greeted by a message that reads: "Welcome to The Bitcoin Business Suite. Please authenticate yourself to continue."

By entering the PIN and passphrase on your Coldcard MK7, securely connected to your station, you unlock both your bitcoin wallet and the corporate TBBS profile. You love your slick custom dashboard—it shows a birds' eye view on the business:

- Current accounts and balances

- Revenue and expenses

- Reputation score in the Web of Trust (WoT)

- Recent transactions

- Pending incoming and outgoing payments

- An Inbox with messages from clients and partners

- And the value of bitcoin, of course

First, you check payments. One incoming transaction. Great, Trace finally settled for the custom audio plugin for his Honda droid that you delivered over a month ago! Better late than never. You click Acknowledge Payment. "The payment has been acknowledged and timestamped."

You know Trace personally and are sure that, despite his difficult financial situation, he is an honest man. Why not help him by boosting his reputation a bit? "Trace commissioned me to develop a custom audio plugin. Everything went smoothly." Signed with the Coldcard, timestamped, posted in the WoT.

Next, you need to pay an invoice that came from your VR media manager. A Lightning transaction is compiled as soon as you open it. All you need is to sign off. This is not a large sum, so it is charged to your warm wallet. No need for the Coldcard this time. "Thank you! The payment for Invoice BTB-615 has been sent. Awaiting acknowledgment from the recipient."

Finally, a new contract came in. This one will keep you busy for a few weeks: a client needs a fork of the popular droid distribution with non-trivial changes. You like the conditions, and the client agreed to pay according to milestones. What could be better? You click Sign Contact. "Please confirm this action on your device." After validating the contract's hash on the Coldcard's screen, you proceed. "The contract has been successfully signed and timestamped."

Under the hood

At first sight, the scenario mentioned above does not look that innovative. You can already perform all these functions from the comfort of your chair. Besides some nerdy terms, what is different?

Let us open the hood and see what is going on down there.

The hardware wallet

You may have noticed that a hardware bitcoin wallet (Coldcard, in our case) is used for the majority of operations. This is no coincidence. As mentioned earlier, besides monetary transactions, the bitcoin protocol can perform other types of unforgeable actions. Namely:

- Authentication. Today's wallets already use the U2F open standard and can act as a second-factor authentication devices. But why not turn your bitcoin wallet itself into an identity? After all, your seed phrase is an extremely important piece of information that you store securely. The wallet is derived from it. In theory, a business identity could be as well. Or a different protocol, such as ION, may be utilized, with the device used additionally in the authentication layer.

- Signatures. The ability to sign a custom message with a bitcoin wallet private key can be utilized for signing and validating contracts. While this can be already done with PGP or even Keybase's Saltpack, what we want is to minimize the amount of software or hardware in the suite. You simply use the hardware wallet to sign a custom message that contains contract details.

Timestamping

Using OpenTimestamps or a similar protocol, built on top of the bitcoin blockchain, you may prove that an event happened or a piece of information existed at a particular point in time. This information cannot be forged and, once confirmed, stays on the blockchain for all eternity.

That is why we timestamp all possible actions that may need proofs in the future. Trace may claim he never received your software, but you have a cryptographic proof that he did, signed by Trace's identity and timestamped at a particular bitcoin block.

Web-of-Trust

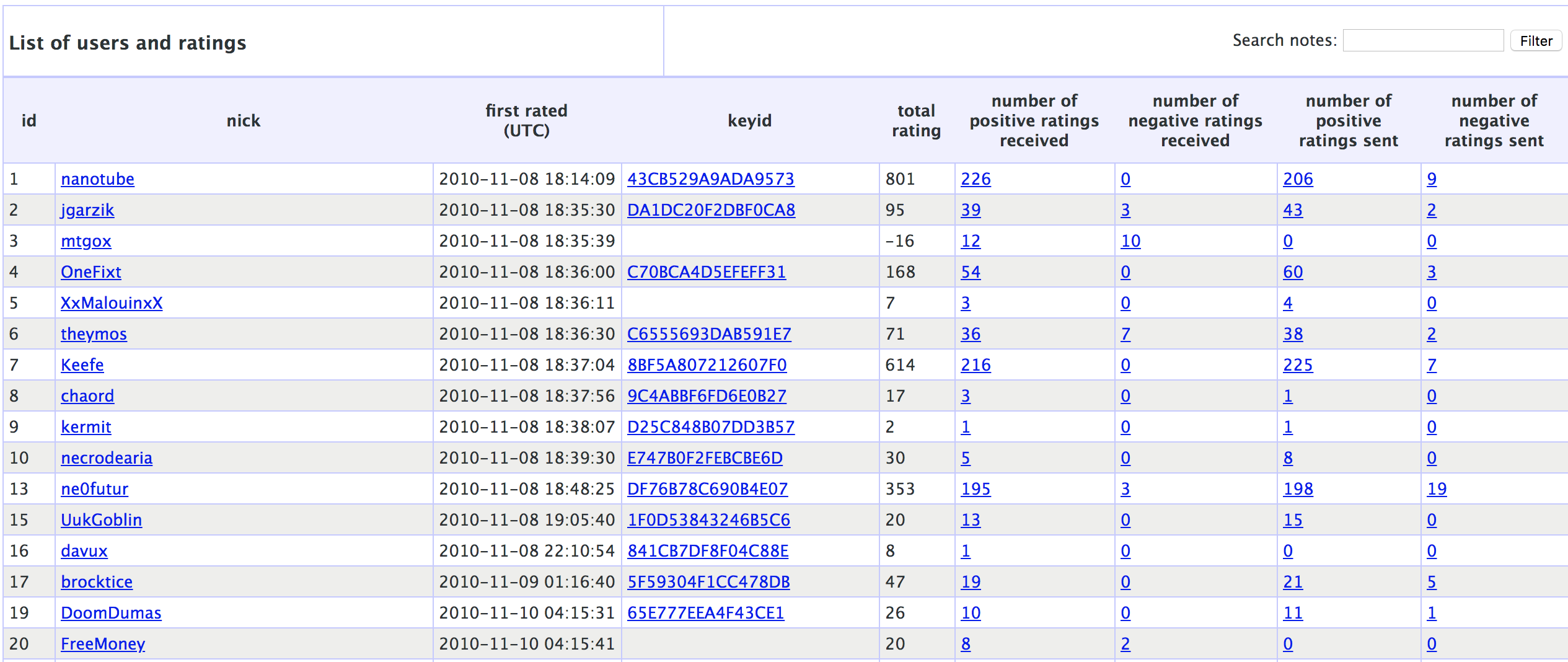

An important feature of a free-market economy, especially one in which many participants are pseudonymous, is a web-of-trust (WoT). In the New World, your success depends largely on merit. Reputation is paramount, so trust systems are in place that make sure the marketplace favors good actors and drives out bad. Uber and Airbnb use such methods today. We only take them a step further.

By rating your company and providing feedback on the job done (signed and timestamped, of course!), Trace adds to your credibility. With an increased WoT score, your reputation among custom software providers grows, and you get more clients.

Arbitration

In case of conflict, private arbitrators can be engaged. Arbitrators themselves are registered TBBS users and are part of the WoT. Selecting them is no different from choosing another service provider: the more reliable ones will have high ratings and an impeccable reputation.

Today, services like Bitrated already provide such functionality specifically for the bitcoin economy. We only need to bake it into the suite.

Conclusion

Let us return to the reasons why today's entrepreneurs choose offshore jurisdictions for their business and apply to them our observations.

- Taxation. Since most offshore jurisdictions do not have corporate taxes, we may conclude that our blockchain-based entity, similarly, is akin to an offshore corporation. Bitcoin is nowhere and everywhere at the same time. If your business is registered on the bitcoin blockchain, the registry itself is necessarily distributed among tens of thousands of computers worldwide. It is offshore on steroids. Naturally, once you take money out of your business for personal use (transfer from the company bitcoin wallet to a personal one or exchange for fiat in your bank account), you may be liable to pay personal income tax.

- Banking. This issue is solved at the onset. In a circular economy, there is no need for a business bank account when you have bitcoin!

- Law. As discussed, offshore legal systems are replaced with private law. Private arbitrators will be able to provide dispute resolution services for a fee. They are incentivized economically to be honest. As Warren Buffet said, "It takes 20 years to build a reputation and five minutes to ruin it."

The vision of the future outlined above may be a bit simplistic and ignores more complicated issues when it comes to international business and law. I believe, however, that such changes may become possible or even inevitable with the proliferation of bitcoin and its establishment as a world reserve currency.

In no way this is legal or tax advice, and I do not recommend anybody to circumvent current laws and regulations. While offshore operations are a legitimate way of doing business, blockchain entities are unproven, untested, and still quite alien. On the other hand, governments, however slow and inefficient, may one day recognize such modes of operation as valid. I doubt they will do it preemptively, however. Most likely, we will see an unregulated bitcoin economy develop on its own, followed by nation-states admitting their helplessness in stopping it (just like bitcoin itself) and, finally, accepting it as a legitimate way of doing business.

We have only scratched the surface of the potential that bitcoin brings to this world. An independent, uncensorable, unconfiscatable money is a catalyst for an independent, uncensorable, unconfiscatable market. In my mind, it is not a fantasy but only a matter of time.

Will you be a part of it?