On September the 27th, 2018, the Liquid network went live.

"As the world’s first production Bitcoin sidechain, the Liquid Network provides fast, secure, and confidential transactions to address the needs of exchanges, brokers, market makers, and financial institutions around the world."—Blockstream

Liquid has been operational for over a year and is, by all standards, getting traction. Why do we need it? What is the network's status now? Where is it headed?

Here, I will cover these and other questions so that the reader may have a better understanding of how the sidechain operates and what its purpose is.

What is Liquid?

The Basics

If you have used bitcoin, then you are familiar with the following characteristics that one may consider "drawbacks":

- Slow and variable transaction confirmation times. Bitcoin's transactions are confirmed on the network when they are included in a newly mined block. Due to the nature of mining, a block is discovered every ten minutes, on average. Sometimes it is faster, other times significantly slower. Considering that many businesses prefer to wait for 3-6 confirmations, transaction finality may take hours.

- Open balances. The bitcoin blockchain is a publicly accessible ledger of accounts. Anybody can download a copy of it and explore as they please. Although wallet addresses are not usually tied to an identity, in some cases, it is possible to guess to whom they belong by using certain heuristics. Nowadays, blockchain analysis is its own field. If there is a chance that your identity is known, then, at the very least, you may not want the world to know how much bitcoin you hold and transact with.

- Lack of native asset issuance capabilities. Issuing assets (tokens) on the bitcoin network is not something everybody wants. Especially, considering the plethora of scams that popped up during the ICO mania of 2017. Arguably, BTC is all you need. But businesses are still experimenting with alternative security issuance and circulation models. Moreover, the so-called stablecoins, that are issued as blockchain tokens, are already challenging the legacy payment rails like SWIFT and SEPA.

I put the word "drawbacks" in quotation marks on purpose, because these are intentional. Bitcoin's base layer is supposed to be minimal and robust because it is responsible for the most important feature of the network—its monetary policy. As developers will tell you, the fewer bells and whistles—the fewer attack vectors. Therefore, any advanced functionality that the end user may desire is best suited in adjacent networks and "Layer 2" solutions. Liquid is one of them.

How does Liquid address the aforementioned issues?

- Transaction times are faster. Variability that is inherent in traditional bitcoin mining is removed as time-based blocks are introduced. A new block is produced exactly every minute. The transaction is considered final with only two confirmations. When time is of the essence, two-minute settlement is much preferred.

- Amounts are hidden. Thanks to Confidential Transactions, a technology that blinds transaction amounts for everyone but the sender and the recipient, users requiring additional privacy may rest assured that no blockchain analytics will be able to tell how much money is being circulated.

- Assets can be issued. If your business wants to issue securities that possess features like high transportability and divisibility, Liquid provides native token issuance with a single command. No need for complex smart contracts or coding experience.

Now that I have covered what Liquid is, let us touch upon the topic of its target audience.

Who Is Liquid For?

The Liquid network is a different thing to different people. Below are some categories of users that, according to my understanding, will benefit from its feature set.

- Exchanges. It is no secret that online exchanges often trade with each other and keep inter-exchange balances. Smaller exchanges may piggyback to larger ones for liquidity when necessary. How much money they move around is traditionally considered a trade secret, but not so much with the bitcoin blockchain. Liquid addresses this issue with Confidential Transactions.

- Traders. Individual traders and trading desks around the world depend on fast execution times, should opportunities arise. As bitcoin's mainchain cannot guarantee that, they often have to maintain multiple balances on different trading platforms to be able to execute trades simultaneously. This results in increased counterparty risk as well as high capital requirements. Additionally, frontrunning presents a huge problem for arbitrageurs due to bitcoin's open balances. Liquid fixes this.

- Businesses. The legacy way of splitting equity or raising funds will have to be upgraded at some point one way or another. The Liquid blockchain provides a native way to issue company stock that is a lot more flexible to deal with. As most securities are already digital anyway, I believe blockchain-based alternatives will emerge and eventually replace the old structure.

- Users. While I consider Liquid a b2b solution, there are use-cases for the average individual. Fiat currency tokens that are pegged to respective balances in private savings accounts and are often referred to as "stablecoins", present a new way of money transmission. With Liquid-issued stablecoins like USDt or L-CAD, one can make peer-to-peer fiat transfers around the world in an expedient and private manner.

The Liquid network provides the tools for development of novel approaches to money transmission, securities emission and even exchange capabilities (non-custodial exchanges, decentralized forex markets). Now, it is up to entrepreneurs to come up with products and services built on top on the side-chain and cater to various market segments. As more applications emerge, more market participants will find it useful!

El Cartel

Is Liquid, in essence, a cartel of influential businesses? At present, such an assertion would not be without grounds.

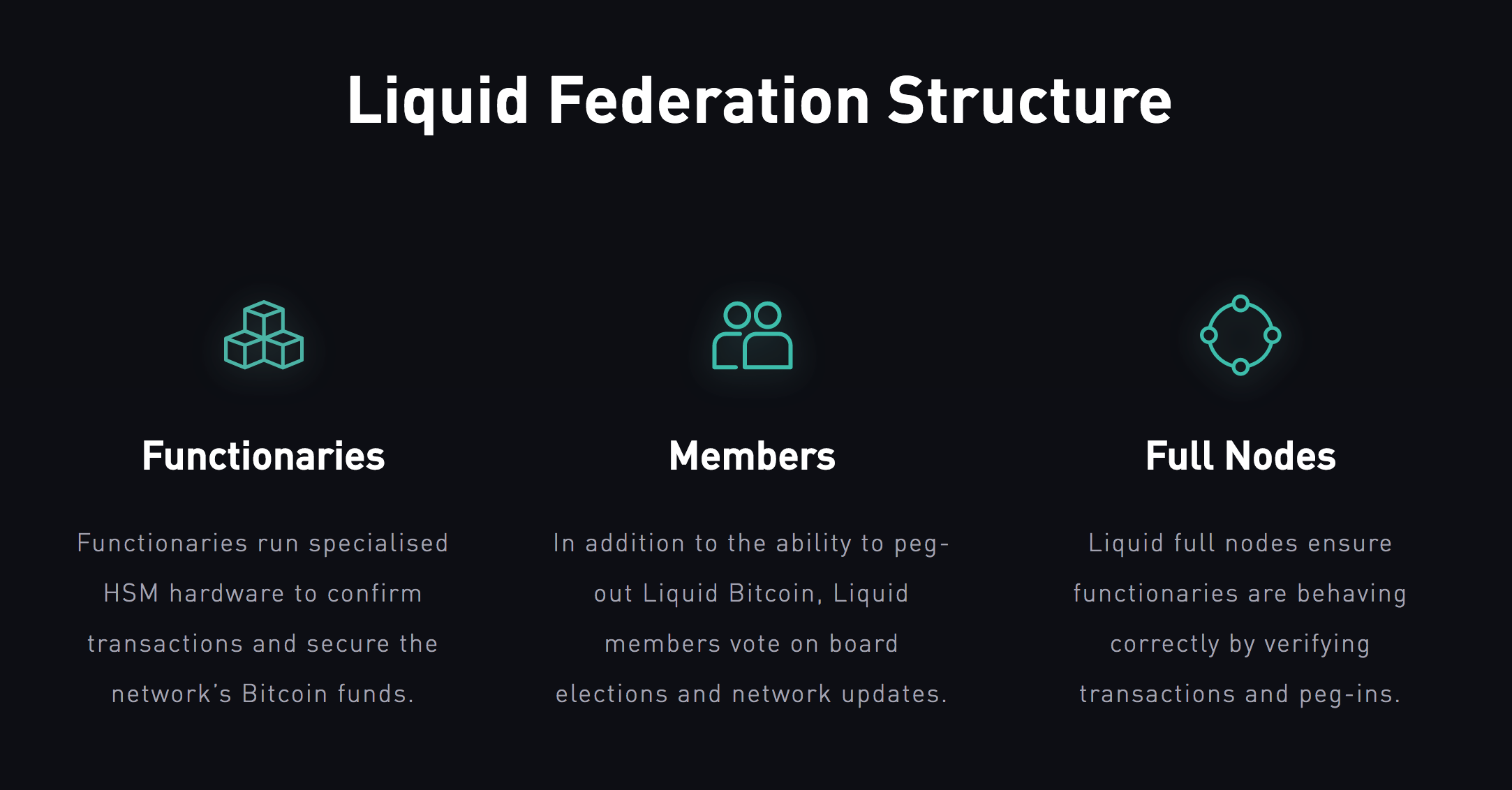

Currently, the network is run by forty-five members, including fifteen functionaries. What does it mean?

- Functionaries replace miners. As there is no proof-of-work mining on Liquid, transaction processing is done via specialized hardware (hardware security modules, or HSMs) hosted by fifteen members of the Federation (functionaries). Why only fifteen? This is due to the limitations of the current multi-signature wallet model in Bitcoin itself. With promising new technologies like Taproot (on Bitcoin's side) and Dynamic Federations (on Liquid's side), this is likely to change. The more independent functionaries dispersed across the globe, the better.

- Members govern the network. Most members of the Liquid network have the ability to peg-out bitcoins, i.e. transfer them back onto the main chain. Additionally, members may participate in yearly elections of the Federation's boards that are responsible for the development of the ecosystem. Currently, there are three boards: Membership, Oversight, Technology. Naturally, the more members, the bigger the variety of candidates for board seats.

- Full nodes validate the rules. Like in Bitcoin, Liquid users do not have to rely on third-parties to verify that the transactions they receive abide by the rules of the network. By running an instance of the full node, participants can send and receive transactions independently.

As the number of members and functionaries is relatively small today, it is possible, in theory, for the majority of them to collude on certain issues. Transaction censorship and peg-out refusal on the technical side, political games on the social side are not far-fetched.

If the network is to break free from the cartel-like appearance and behavior and become the backbone of the new financial system, it must strive for more than just user and member growth. As I envision it, there can be three scenarios of Liquid's development:

- The network is co-oped. In this scenario, the majority of decision-makers on the Federation's boards are representatives of the old financial elites as well as various government bodies and agencies. When most functionaries are run by such entities and the majority of board members are their agents, it is not difficult to imagine Liquid turning into an upgraded version of the legacy financial system.

- The network is independent. If the number of members and functionaries grows dramatically, with no single participant or faction exercising more control than others, there is a good chance that Liquid will deliver on its promises to become the backbone of the new financial system. While legacy players may take advantage of its unique selling propositions, they will not be able to modify its inner workings unilaterally.

- The network ceases to exist. It is also possible that competitive networks will take over. Liquid is but one piece of technology that strives to solve the issues inherent to Bitcoin's base layer. The Lightning network, for example, besides instant transactions, may also offer privacy-increasing features and even issued assets.

I am, of course, interested in seeing the Liquid network succeed. Arguably, both points (1) and (2) may be considered a success. However, as it is my conviction that there can be no resetting or upgrading of the hopelessly fraudulent financial system of today, our goal is to create a parallel economy based on laissez-faire market relations and backed by the hardest money to ever exist—bitcoin. This means that Liquid must remain and further grow independent in accordance with the wishes of its free-market-oriented members rather than the influence of nation-states and supra-national entities.

How to ensure Liquid's success

What does a successful Liquid network look like? How does it operate? Who runs it? I will attempt to answer these questions in this section.

Incorruptibility

From the very beginning, it was known and communicated that Liquid is a permissioned blockchain. This means that it may never achieve the level of decentralization that Bitcoin boasts today. But for its intents and purposes, it does not have to.

As the sidechain is created primarily for business-to-business transactions, it must be sufficiently decentralized to remain incorruptible. Compare it to an international consortium or a guild of traders who are independent members pursuing their own financial goals while, at the same time, being united by an organization with common objectives. By creating a private network, by the rules of which they agree to abide, the merchants achieve increased efficiency in areas such as transaction settlement, business networking, supply chains and so on. Similarly, bitcoin businesses are united on the Liquid network by shared desires for faster settlements, transactional privacy and the use of digital securities.

Incorruptibility means that it is difficult to compromise the majority of members to effect a hostile takeover. How can it be achieved?

- More members. With Dynamic Federations (DynaFed), an upcoming Liquid feature, the network will be able to handle a much larger set of members in a dynamic manner (it is quite manual right now). This will provide a larger set of candidates for board seats and make the Federation more competitive.

- More functionaries. Fifteen functionaries, although independent and dispersed across the globe, may not be enough to secure the integrity of transaction processing. A motivated coalition of governments or a supra-national entity could exert enough pressure on the majority of functionaries. Like in bitcoin mining, further decentralization is desirable. DynaFed will allow this, too.

- Anonymous members. Right now, all members of the Liquid network are known companies working in the bitcoin industry in some capacity. However, with the rise of the parallel economy, it is conceivable that anonymous or pseudonymous players may achieve financial weight and positions of technical and political influence. I believe that such players must be encouraged to become part of the network. Due to their nature, such participants are more difficult to compromise or influence in any non-market way.

Contingency

The beauty of systems like Liquid is that they are open-source. Anybody can fork the code and spin up their bitcoin side-chain today. It is, however, an effortful undertaking, especially when it comes to maintenance. So, why would one do that?

In my opinion, spinning up a fork of the network must be part of a contingency plan. It is a nuclear option is situations like a hostile takeover of the main Liquid network. Which process may be fast and furious or slow and insidious.

There may be various parties who would love to have control of a powerful financial network as we all learned from the recent history of Bitcoin. This is why a secession plan is necessary. In Liechtenstein, municipalities have the constitutional right to secession if they do not agree with the government policies. In the same manner, a number of influential Liquid members may have a plan to branch off of the main network. Liquid will receive a financial and reputational blow, and the new network will start strong.

A Success Story

Liquid's success relies on its members' future decisions on governance, membership and infrastructure. The underlying technology is neutral, it understands no politics. Whether the network becomes an upgrade to the existing financial system, with legacy players migrating to it, or rises as the backbone of wholly new type of economy, with its own set of rules, is up to us.

My conviction is that, with bitcoin and technologies like Liquid, we finally possess tools to build a New World based on the principles of laissez-faire economics and property rights. Therefore, I will push for a more open and censorship-resistant Liquid network run by a guild of respected entrepreneurs from all parts of the world. At the same time, legacy market institutions are welcome to join the network as long as they understand and abide by the rules of the new economy. Which, in many cases, means no rules at all!

Going Forward

To end this article, I will outline my personal plan for Liquid. It is based on my preference for establishing a parallel, circular bitcoin economy with low barriers to entry and minimal friction.

I will:

- Run a bitcoin business that is fully integrated with the Liquid network;

- Establish close working relationships with other significant players on the network;

- Invite and encourage fully anonymous, pseudonymous and unregulated enterprises to join Liquid;

- Watch closely the direction in which the network develops;

- Report openly any doubts or concerns that I may experience.

I invite all the entrepreneurs with a similar vision to join me in this endeavour. Let us unite and turn the Liquid network into a global, digital Galt's Gulch!