Have you ever thought about fraud from fraudsters' point of view? Often, we imagine immoral sociopathic individuals who are too lazy to have a real job, so they "work" people instead. It is not far from the truth in many cases, but I believe there are deeper unresolved issues within these lost souls that make them who they are. Family-related trauma, psychopathy, or multiple factors combined can lead a person astray, into a life of lies and manipulation where they feel in control.

But just like "normal" people form voluntary circles based on mutual interests, scammers have their social circles too. Within those groups, some are friends, some are competitors, but all are scammers. Not only do they exchange the latest fraud tricks among themselves, but they also brag about their achievements. "Nice work there, fellah! You really earned that watch!"

We are not going to delve into the psychology and rituals of fraudsters in this article (I would not know about the intricacies anyway) but will explore what it would take to scam the whole planet out of their money and get away with it.

Imagine you are a megalomaniac who wants unlimited power over the world. Money is power, so you decide that to achieve your goal, you need to be able to have unlimited capital. Not an easy task, indeed. It will take a lot of time. Perhaps, generations.

And it did.

A Crash Course on the History of Money

Understanding the current state of affairs in a particular domain often requires learning about its history. Money is not an exception.

Dollars, euros, and rubles are mundane to us. We take them for granted like the sky above our heads. Surprisingly though, we learn about the latter quite extensively in school, while the former is barely covered. The history of money does not invoke pride. You see, scammers took over the whole thing.

Allow me to cover the basics.

You Give Me Fish, I Give You Apples

Thousands of years ago, before the appearance of first money, trade took place by way of barter. Barter is exchange of goods and services for other goods and services. Domestication of cattle and development of agriculture allowed for increased supplies of various products that could not all be consumed by the producer. A cattle rancher, then, would butcher a cow and exchange the meat for some wheat, clothes, or tools.

There is a problem, however.

"A major disadvantage with barter based trade is the double coincidence of wants problem. An apple grower may desire trade with a fisherman, for example, but if the fisherman does not desire apples at the same moment, the trade will not take place."—Vijay Boyapati, The Bullish Case for Bitcoin

You can imagine how quickly you run into an impasse when wanting something that others have but not having what they want. Even though barter has survived to this day, it could not allow for trade to scale and become more efficient. If only there existed something that all or most people wanted.

From My Collection to Yours

The ineffectiveness of barter made people realize that they needed something else that holds value and is accepted in exchange for goods and services.

Around the world, local populations found out that various commodities fit that role well enough because they were wanted items in those geographical regions. Native Indians of North America used seashells and decorations made of skeleton parts, such as wampum, as collectible items.

"Wampum pendants came in a variety of lengths, with the number of beads proportional to the length. Pendants could be cut or joined to form a pendant of length equal to the price paid."—Nick Szabo, Shelling Out

The territory of modern Russia had many tribes who traded with each other using pelts of small fur-bearing animals. The more exotic the fur, the higher its value. Squirrel and marten pelts were popular export items as they were highly valued in far-away regions. As for imported collectibles, shells of kauri that came from southern areas were widespread because of their size and convenience.

While such collectibles served the purpose of money well enough within a particular geographical area or among a few neighboring regions, they were not in demand universally. Moreover, most of these commodities were perishable or not durable enough to withstand severe physical conditions. Shells could be broken, and pelts could be burned or spoiled beyond repair. Another downside was that merchants from regions abundant with certain goods much appreciated in other places had a clear advantage. Imagine exchanging a few seashells that you found on a nearby beach for a beautiful pelt that would cause envy on the part of your neighbors. Hardly a scam, though. You are only taking advantage of inefficiencies on the market.

My Precious

The rise of precious metals as a form of money produced a tremendous effect on the development of our civilization. Qualities like durability, divisibility, and scarcity made them universally sought after. Gold became the synonym for value, with silver being its little brother.

Because it is difficult to mine gold due to the amount of time, effort, and monetary investment required to do so, economists call it "hard money." Compare it to "easy money," like the United States Dollar, which is trivial to print at will at almost no cost. If you had a choice between a classical painting that took months to finish by a gifted artist and a work of modern art produced in less than a day, what would you pick?

When coinage became popular due to the convenience and transportability of coins, private mints started appearing all over the world. Circulation of gold and silver coins expanded dramatically. Some mints gained such an impeccable reputation that their coins were in demand far from home.

Interestingly, while merchants preferred gold almost everywhere there was trade, a few places gave preference to silver and got rid of gold as soon as they could. Chestfuls of silver coins, usually foreign, were unearthed in Russia, but not much gold.

Under the gold standard, most currencies were backed by gold reserves, at least to some extent, up to the end of the 20th century. Even in today's world of fiat money, central banks prefer to hold gold in their vaults as a safe-haven asset. Some countries, like Russia and China, have been stockpiling the precious metal for the past few years.

"Some of the most important technological, medical, economic, and artistic human achievements were invented during the era of the gold standard, which partly explains why it was known as la Belle Epoque, or the beautiful era, across Europe"—Saifedean Ammous, The Bitcoin Standard

"But when do we begin scamming people?" you may ask, growing impatient.

Precious metals and coin minting, in particular, gave scammers their first significant way of deceiving people en masse. One way you would defraud counter-parties was by minting coins that had less precious metal than their face value claimed. You would encase non-precious metal with similar weight in a shell made of gold or silver. This process is called debasement. The longer the fraud went on unnoticed, the more daring you became. Soon enough, some merchants realized that what they held in their reserves was not worth as much as they thought. They started verifying what they were getting. But you, as a scammer, know well that your target audience is the gullible masses. Congratulations, you are rich!

Centralize and Rule

As time went on, some entrepreneurial minds realized that storing gold at home was risky and carrying it around even more so. Why not create a facility in which people's wealth can be stored securely for a fee? Banks were born.

To account for how much gold was held by whom, these early banks issued paper receipts that bearers could exchange for the metal on demand. The first "bank notes" were a lot more compact and transportable that the actual specie. No wonder that soon enough, individuals started forgoing redemption of notes for gold and using them as currency. What could go wrong?

Indeed, convenience was a trade-off that opened new opportunities for those with a broken moral compass.

"As in the case of debasement, banknotes have been falsified both by ordinary criminals and by the "guardians" themselves."—Jörg Guido Hülsmann, The Ethics of Money Production

Of course, many bankers were honest business people. But if you intended to scam all along—jackpot!

Now imagine you are a sovereign who is short on funds in the coffers but desperately needs them to, say, start a war. You could raise taxes, which would not gain you much popularity. Having a bank or partnering with a bank that creates fake banknotes is such a better deal! Print more notes, pass them as receipts for gold that you do not have, buy weapons, supplies, men. Genius!

There is one problem, though. Merchants are not all stupid and know about debasement and fake paper notes. They want the shiny metal! How can you fix the situation?

To do so, you need three keys.

At this moment, you remember that you are a sovereign, which means that you write the law. "You shall accept these banknotes as payment or be punished." Signed. In effect immediately. Legal tender is now a thing. And you, dear sovereign, now possess the first key to unlimited wealth.

Just like that, what used to be illegal for everybody, became legal for a privileged few. Counterfeit receipts not backed by anything magically became forced currency. Issuers would have to have gold reserves anyway, of course. While they knew that not everybody wanted to redeem banknotes for specie, many merchants preferred to hold on to physical gold.

With time your appetites grew. Gold reserves themselves became a hindrance if you wanted to expand currency supply beyond the level that was still tolerable to the few merchants "in the know."

It is important to note that before the era of central banking, issuance of money, whether it was gold or silver bars, coins or notes redeemable for them, was decentralized. Various mints and banks in the same country could be engaged in the process. Naturally, decentralized money creation was more challenging to control as you had to negotiate with multiple parties. The appearance of central banks was just a matter of time and a massive victory for those who desired power and control. They represent the second key.

"I care not what puppet is placed upon the throne of England to rule the Empire on which the sun never sets. The man who controls the British money supply controls the British Empire, and I control the British money supply."—Nathan Mayer Rothschild

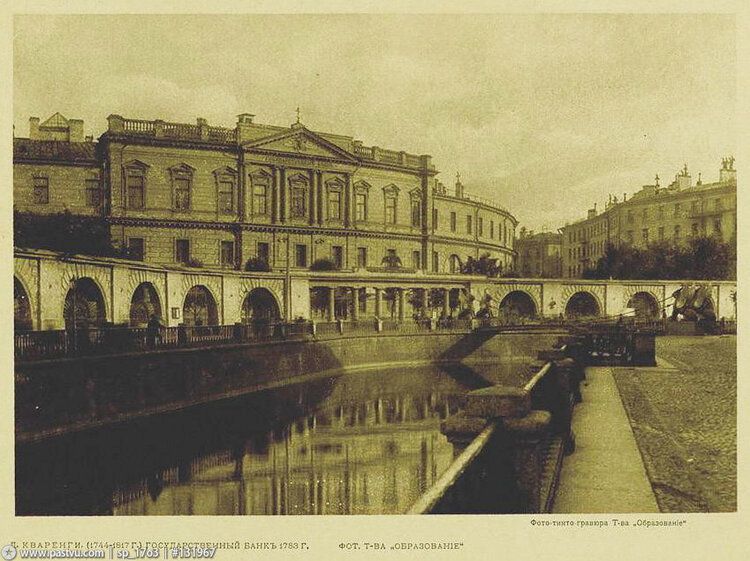

British and American central banks became the prototype that the countries in the rest of the world would eventually follow. For example, attempts at creating a central bank in Russia, modeled on The Bank of England, started back in the 18th century. The first successful long-standing institution, GosBank, was founded in 1860 by Alexander II's decree. After the socialist revolution of 1917, the communists reformed the State Bank, and from the 1930s to 1987, it was the only operational bank in the whole country.

Back to war. Armed conflict is a costly undertaking. With the spirit of conquest and glory behind, reasons for starting wars changed during the last few hundred years. As an ultra-wealthy financier, you see opportunity in the destruction of foreign countries: in case of victory, you would be the one to rebuild them and extract natural resources from their lands. And going as far as funding both sides of the conflict would guarantee a victory.

Now that you hold two essential keys (a central bank and legal tender laws), you only need one more to unlock the sluice holding an unprecedented flood of money. Remember that your only constraint is those gold reserves that can be called upon on demand. Time to get rid of this annoyance altogether!

"To finance the unheard-of destructions of World War I, the central banks of France, Germany, and Great Britain suspended the redemption of their notes. Needless to say, this happened with the approval and in fact at the behest of their national governments."—Jörg Guido Hülsmann, The Ethics of Money Production

In 1971 another such temporary suspension in the USA turned out to be permanent. The United States dollar became the de facto world reserve currency, solidifying and spreading around the concept of paper money. Fiat currency is your third key. The gate is open.

What you have created is paper banknotes that:

- cannot be redeemed for gold;

- are illegal to reject as a method of payment in your jurisdiction;

- can be printed ad infinitum only by you.

How does it feel? I am quite sure that it feels like being on top of the world.

You have successfully scammed the planet.

A Turn of the Tide

As a result of your fraudulent work, you have access to virtually unlimited wealth, top political connections, unique business opportunities. Destinies of whole nations may depend on your whims! If what you have pulled off is not the biggest scam on the planet, what is?

Of course, with time, you will have to adjust your strategy and come up with new schemes and explanations to keep the fraud machine running. Most people are ignorant, which has been your best bet since the beginning, so there is not much to be afraid of.

Unless, miraculously, someone creates a competitive currency that even you cannot control. The printing press is yours, and gold, in your opinion, has little chance of return. This new currency has to be something out of this world.

This is when you hear about bitcoin.

You laugh it off, at first, like many people do. Still, you do not trust the opinions of the experts whose jobs these days depend on your funding. The many centuries of fraud that your family has engaged in, however, provide a wealth of knowledge and experience that make you feel uneasy about this one.

"It cannot be true," you say to yourself. "Bitcoin must be stopped.”

How to Scam the Planet is a series of articles that explore how billions of people on earth have been led to accept false realities as truth. Together, we get in the shoes of scammers and learn how they invent fraudulent schemes and execute them successfully on a global scale. Stay tuned for more updates!