There has been a lot said about central banks recently. The monetary standard upon which rests the whole financial system of our world has been thoroughly criticized, debunked and shown for what it truly is—a fraud of global proportions. In this article, I will simplify some of the concepts behind central banking so that you need no financial background to understand the absurdity of the system.

Coming from a non-financial background myself, I spent a lot of time trying to grasp the mechanics of the system we have now. To be honest, I still feel that there is a lot more to learn if I wanted to get into detail. Do I need to, though? Or are there some simple truths that are more than enough for one to make one's mind about the subject? Forget economics and finance, drop your thousand-page volumes and three-hour documentaries. Read below.

First, the Facts

Fact 1 - Central Banks are Private Companies

It is a little known fact that central banks are, for the most part, private companies. Legally, they are not part of any government. Moreover, the shareholders of such corporations are often undisclosed.

While such names as the Federal Reserve or the Central Bank of the Russian Federation may impress an ignorant individual otherwise, public documents confirm the statement above. For instance, in 1982, court ruled that the banks involved in the Federal Reserve system were "independent, privately owned and locally controlled corporations", and there was not sufficient "federal government control over 'detailed physical performance' and 'day to day operation'" of the Federal Reserve Bank for it to be considered a federal agency.

Similarly, in Russia, the central bank is a commercial organization that has little oversight and influence on the part of the government, as will be shown later.

So, what we have as central banks are private companies run by private, often anonymous, individuals. If you are aware of the role of a central bank in a given country, you may already imagine the power such individuals have.

Fact 2 - An Exclusive Partnership

These private companies enter into an exclusive partnership with governments. It is a business deal in which central banks bring in the money (like VCs), and governments execute on commercial objectives (like C-level employees).

There is, however, a huge disparity in such a partnership. Imagine you have a business with someone: your partner is responsible for funding the project, while you get to actually work on the tasks at hand to achieve business goals. Quite a normal relationship. But now, let us assume that your partner has unlimited money. He can literally bring in as much investment as needed. As you understand, the power dynamics in such a company is completely in favour of the partner with the funds. The reason for that is simple: such an investor can find someone else to execute on the agenda, but the other partner is unlikely to find a replacement for the unlimited-money guy.

And such is the relationship between a central bank, an entity that not only provides the money but creates it, and a government, an executive body. Yes, it is a mutual business and, although "the Federal Reserve derives its authority from the Congress", we must remember who funds the Congress. Like in a small business in which a powerful financier-partner may give concessions and an appearance of decision-making powers to the lesser executive in order to keep him motivated, so does a central bank gives its partner government certain levers that it can play with.

What do these two simple facts signify? What is the result of a business partnership between an entity that can print unlimited money out of thin air and an executive body that can affect a country's internal and external affairs?

Who Owns It All?

In economics, a market participant always strives to acquire capital. Capital can be represented by various vehicles but the most popular are, naturally, those that are scarce. Historically, land and precious metals like gold have been the choice of many. Bitcoin is becoming the go-to store-of-value in the twenty-first century. The best way to accumulate such capital is, of course, through work: provide goods or services that the market wants, save your earnings, convert them into a desired store-of-value. But if you run a company that convinced a whole nation to use money that you can print at will (with the help of the nation's government, of course), then all you have to do is to print as much as you can for as long as you can and use it to purchase real assets. Yes, that is right: you print pieces of paper and exchange them for land, gold, bitcoin, stocks and government bonds. If this sounds incredible, all you need to see is this.

The Fed now owns a total of 22,913 different securities according to Bloomberg. It is the world's biggest investor pic.twitter.com/xTB1lkudLg

— zerohedge (@zerohedge) August 30, 2020

Real investors work hard to earn money that they will then invest. The Fed simply prints money that nobody can refuse to accept: legal tender laws passed by their business partner—the government—make sure of that.

With some differences, most central banks in the world are modelled after the Federal Reserve. More interestingly, due to the status of the US dollar as the reserve currency, these central banks only appear independent. In reality, they issue their local currencies not "natively" as in the States but based on the amount of dollars in their reserves. For example, the Bank of Russia can only print rubles against the US dollars on its balance sheet.

But how does the Russian central bank prove it has those dollars? It does not have to because the storage of the reserve currency is outsourced to international banking organizations: the IMF and the World Bank. So not only the Bank of Russia is fully dependent of the US dollar, it is not even trusted to store the bucks.

In business terms, it almost looks like the following structure: the Fed is the main corporation, central banks of other countries are its subsidiaries and the IMF and the World Bank serve as holding companies or trusts. The latter can issue loans to subsidiaries which are rarely paid back: instead, local governments give up their land, natural resources and other real assets.

What is the natural conclusion that can be arrived at based on the information provided? I think it is quite simple: most of the world is run by central banks whose chief is the Federal Reserve bank of the United States of America (with the European central bank rivalling its position). Taking into account the fact of private ownership, I can go as far as state that the global economy is in the hands of a bunch of private individuals. Of course, they are unlikely to be micro-managing everything that goes on in a market comprised of over seven billion individuals, but high-level decisions are made quite regularly.

An Exclusive Club

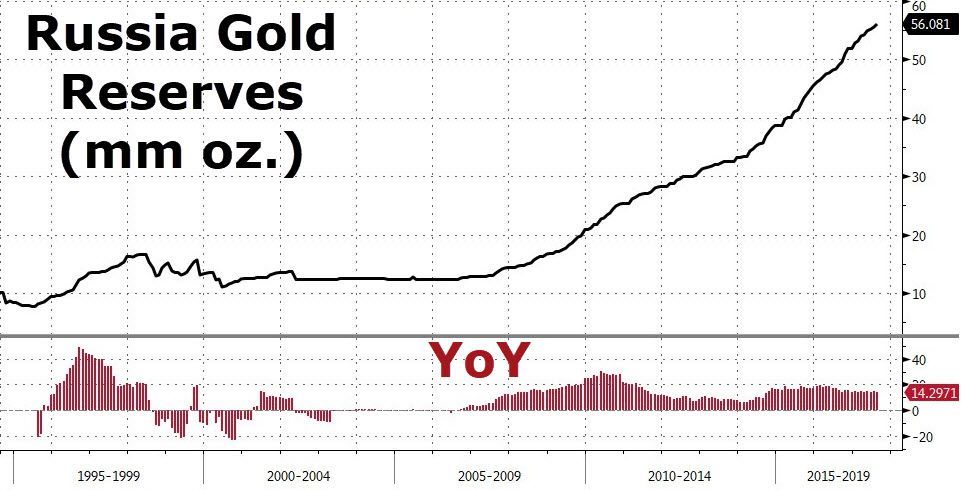

Take a look at Russia again. According to reports, the country has been stockpiling gold over the past several years. Its reserve has grown tremendously, especially compared to other countries like Canada whose vaults are literally empty.

But there is a caveat. Is it really Russia that has all that gold? Or the Bank of Russia, a private entity? According to the Russian law, the government is not responsible for the Bank's liabilities and the Bank for the government's. What it literally means is that Russia can go bankrupt even if its central bank's vaults are full of gold.

So, in essence, a bunch of private individuals move gold from one place to another around the world and pretend that it is governments that do that. Russia did not stockpile gold—a private bank in Russia did. Canada did not get rid of its reserve—a bank in Canada did. I am not here to say that the owners of central banks are all close friends. They are likely to have competing interests. But they all do come from the same source, and that point of origin must have a bigger say in what generally happens.

A Way Out

In this piece, I wanted to show the nature of the relationship between a central bank and the government in whose jurisdiction it operates. Many volumes have been written on the subject, so I could not have covered all the details even if I wanted. But a high-level explanation in simple terms is attempted here, and I hope someone finds it valuable.

If you are not fond of the idea of central banking anymore and are looking for a solution, look no further. Bitcoin is here, and its main objective is the elimination of central banks. Take your time to study it, and you will understand the importance of what is coming. You still have a chance to become an early adopter, followed by the rest of the world years later when economic reality hits.